The deadline for filing Income Tax Returns (ITR) for the assessment year 2024-25 is nearing (July 31). Most people need the help of someone who is good with accounts and tax filing to assist them during this time of the year. Chartered Accountants (CA) and CA aspirants are often sought after by their friends and family to file Income Tax Returns (ITR).

Recently, Manthan Raichura, a CA aspirant, took to X (formerly Twitter) to vent his frustration

This week, a Chartered Accountancy (CA) aspirant took to his X (formerly Twitter) account and shared his opinion on how some acquaintances remember you only during their time of need.

ADVERTISEMENT

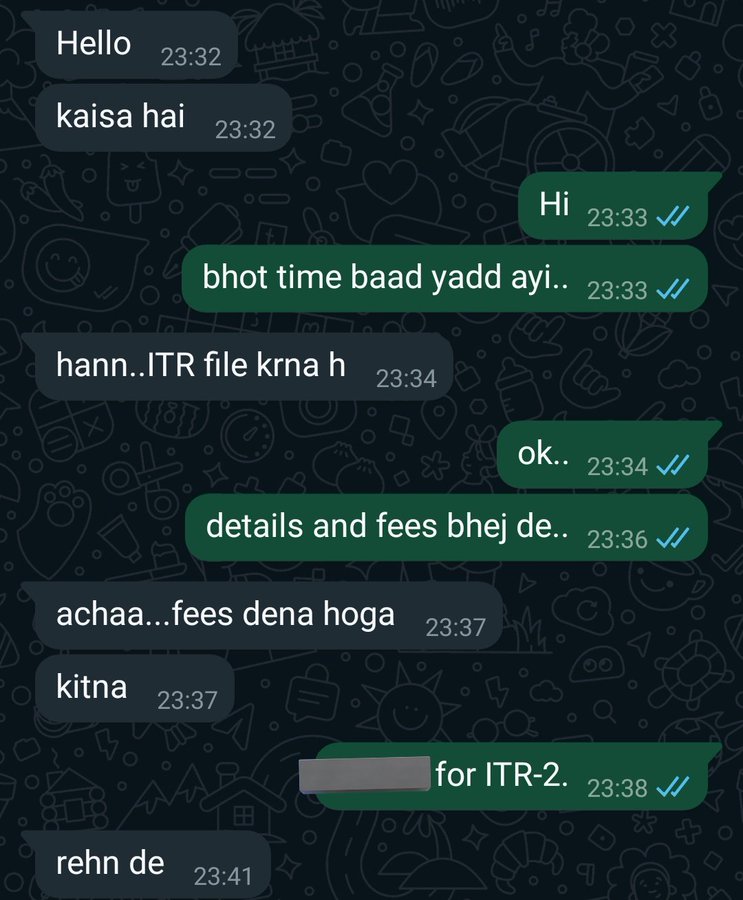

Raichura shared a chat screenshot of himself and an old acquaintance who had not been in touch with him for a long period of time. The conversation started with a simple “Hello” and within some time the actual motive was revealed. Soon the acquaintance requested help with filing his ITR.

The conversation was initiated by the acquaintance who sent a message, and Raichura responded to it with a curious mind unaware of the sudden unknown contact. The acquaintance then replied in Hindi, saying,

“Yes, I wanted to file the ITR.” Raichura immediately cut to the chase, asking for details and fees. The acquaintance responded, “Achaa…fees dena hoga. Kitna? (Oh, I have to pay a fee? How much?)”

Just when Raichura quoted the fee for his help with the ITR, his acquaintance backed out as he was hoping to get the service for free. He left the conversation saying,

“Rehn de (leave it)”

Raichura shared the screenshot of the WhatsApp chat and wrote,

ADVERTISEMENT

“I take no shame in asking for ITR filing fees. It is that time of the year when some unrelated relatives and old disconnected ‘friends’ will call/text for their selfish reason. Why should I feed my time to keep an inexistent relation?”

I take no shame in asking for ITR filing fees. It is that time of the year when some unrelated relatives and old disconnected “friends” will call/text for their selfish reason. Why should I feed my time to keep an inexistent relation? #ITR #ITRseason pic.twitter.com/3VotKFzTOz

— Manthan Raichura 🇮🇳 (@heymanthan) June 23, 2024

He added that no one should feel ashamed to ask for a fee for their hard work and time. The post went viral with over a million views, 11,000 ‘likes’, over 500 re-posts, and over 600 bookmarks.

The post was flooded with comments from netizens. They gave mixed reactions to Raichura’s opinion

One user remarked,

“Bhai, I asked my CA friend to file only after you take money. It is his source of earning; I can’t expect him to do it for free.”

Bhai i asked my CA friend to file only after you take money. It is his source of earning I can’t expect him to do it for free

— Pritesh Jadhav (@priteshisgreat) June 24, 2024

Another user said,

ADVERTISEMENT

“Same for doctors, bro! Why should such people be given free treatment after spending so many years in medical training? Good one. Keep it up.”

Same for doctors bro! Why should such people be given free of cost treatment after spending so many years in medical training. Good one. Keep it up.

— Shubham Singhal (@shubhamxsinghal) June 24, 2024

Bohut hi direct hai dost tumhara. Bro didn’t get the sarcasm of Bohut dino baad yaad aayi. 🤡🤣

I have stopped filing for them rather than doing for free. No means no.

— InMESSIonate (@Fan_LFC_FCB) June 23, 2024

One user said that he happily pays his best friend who files his ITR. Several people backed Raichura by saying that no one should offer their service for free.

Even my best friend charges me for filing my ITR, and I pay him happily.

— vikas (@i_am_Nani_vikas) June 24, 2024

Always charge extra from relatives and friends.

Universal balance needs to be restored.

— Ishwar Singh (@IshwarBagga) June 24, 2024

ADVERTISEMENT

If you have the skills, don’t do it for Free! No one values it – Life lesson 😃

— Blue Prick (@TheBluePrick) June 24, 2024

No such thing as a free lunch, and rightly so 👏🏻

Either people should pay to utilise the skills and time of a professional, or learn and do it themselves.— S. Paul (@paul_sparsh) June 24, 2024

It’s important to set boundaries, especially with those who only reach out when they need something.

— Shobhit G (@shobhitgupta06) June 24, 2024

However, some reactions were not supportive. One user commented,

“Thank God I don’t have a CA friend like you. He’s a friend of 24 years, and we’ve met only thrice in the last 18 years, yet he just asks for my Form 16 and does the honour. I’m blessed I have friends like him.”

Thank God I don’t have a CA friend like you.

He’s a friend of 24 years and we have met only thrice in last 18 years, yet he just asks my Form 16 and does the honor.

I’m blessed I have friends like him.

— Madhav (@ispeakhere_) June 24, 2024

ADVERTISEMENT

Another user suggested that the decline should be proper and respectful. A CA professional supported the decision of Manthan Raichuria. Another user asked Raichura to disclose the fee he quoted so that they could do the same to sway people.

Disclose the fees. We will also quote the same to done away with 🤣

— Rajat Agarwala (@RjtAg222) June 24, 2024

Very good decision.

— CA Ankit (@caankitnagpal) June 24, 2024

Many users asked Raichura about his quoted fees and he replied to most of them

Depends on nature of Incomes & time required

— Manthan Raichura 🇮🇳 (@heymanthan) June 27, 2024

People are eager to know the fees I quoted. I got many queries asking for fees. Dear all, the fees are based on the efforts that would be required for ITR & the Income you earn (can’t charge ₹5K from a person having income of & 5L) and hence cannot be quoted in general. #ITR

— Manthan Raichura 🇮🇳 (@heymanthan) June 26, 2024

ADVERTISEMENT

Though ITR filing has been a lot simpler than before, people still look up to professionals for help. Should they offer their service for free? Let us know in the comments.

ADVERTISEMENT