Every salaried individual contributing to the Employees’ Provident Fund (EPF) in India is issued an EPF passbook – a crucial tool for managing retirement savings. This financial document records all transactions relating to an employee’s EPF account, thus allowing for an extensive understanding of one’s savings.

What Is an EPF Passbook?

An EPF passbook is a digital passbook that records all your Employees’ Provident Fund transactions. Simply put, it is the track record of your contributions towards your retirement savings. The passbook is updated every month when your employer remits your EPF contribution.

ADVERTISEMENT

Providing detailed entries of your monthly contributions, employer contributions, and accrued interest, your EPF passbook is a comprehensive document. It helps you understand how exactly your retirement savings are growing.

How Can You Access Your EPF Passbook?

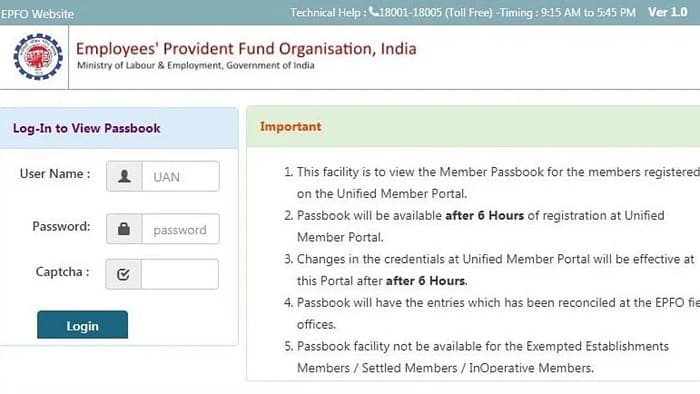

Accessing your EPF passbook is an online process that can be availed using the Employees’ Provident Fund Organisation (EPFO) website. However, to download this passbook, you need to have your Universal Account Number (UAN) activated.

Steps to Download your EPF Passbook

- Login to the EPFO website using your UAN and password.

- Navigate to the ‘Our Services’ tab and select ‘For Employees.’

- Choose ‘Member Passbook’ from the services listed.

- Enter your UAN and password again when prompted.

- You can now choose to view or download your EPF passbook.

Please note that the data in the EPF passbook is coded and contains various column arrivals—deposit refund, interest credit, and withdrawal—which are all mentioned in the passbook.

ADVERTISEMENT

Breakdown of the EPF Passbook

Understanding the EPF passbook entries can seem daunting at first; however, once you know what each heading signifies, it becomes straightforward:

- Membership ID: Consists of your state code, PF office code, establishment code, extension code (if any), and your EPF account number.

- Name: Your name as per the EPFO records.

- Establishments under which your EPF account is maintained.

- Contribution details, including your monthly contributions, your employer’s contributions, and the pension contribution by your employer.

- Interest accrued on your savings during the year.

It’s crucial to review your EPF passbook now and then to ensure that your contributions are being deposited accurately. A periodic inspection provides assurance that everything is in order, and if there’s a discrepancy, corrective measures can be taken immediately.

Closing Thoughts

An EPF passbook holds a high importance in the journey of building a substantial retirement corpus. It’s an excellent tracking tool for analyzing your retirement savings growth and making future financial plans. Additionally, managing EPF online payment adds convenience and efficiency to your retirement savings strategy.

ADVERTISEMENT

However, it should be noted that the financial market’s dynamics can be complex and unpredictable. While understanding your EPF passbook is of significance, it’s equally crucial to weigh all the pros and cons before making any significant move in the Indian financial market. It is always recommended to seek professional help that takes into account your individual needs and circumstances, thus guiding your decision-making process.

Summary

Accessing and understanding your EPF Passbook is a vital part of managing your retirement savings in India. A digital record of all your EPF transactions, it provides details of your contribution, your employer’s contribution, and the accrued interest over time. Through the EPFO website, one can easily download and view their passbook. Although a bit complex, once familiar with the entries, it becomes simple to understand and follow.

Regular monitoring ensures the accurate deposit of contributions, alongside addressing any anomalies promptly. However, it’s essential to understand that the financial market has its intricacies, and thus, one must duly weigh all factors and seek professional advice before making any significant financial decisions.

ADVERTISEMENT